UPI makes digital payments fast and accessible across India, but people are still running into problems such as stuck payments, failed transactions, or confusing errors while transferring money.

Failed UPI transactions can lead to confusion, stress and concern if you have lost money. In most cases, the problem is temporary and happens due to server issues, UPI limits, or incorrect account linking.

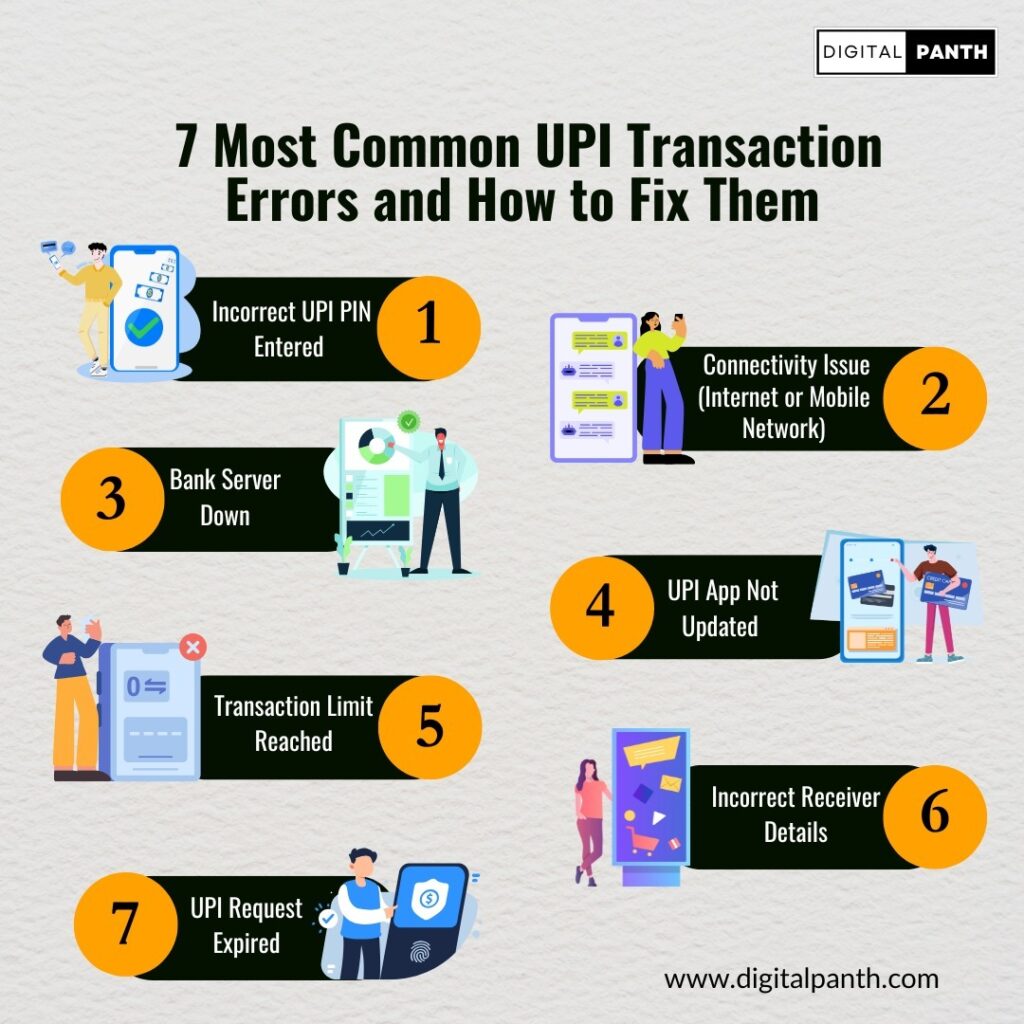

In this article, you will learn about the 7 most common UPI transaction errors, along with their causes and how to facilitate repair.

Note: UPI errors are usually fixable, but avoid sharing sensitive details like PINs or OTPs with anyone. Always use official banking apps and support channels.

Top 7 UPI Transactions – Errors and Quick Fixes

While using UPI, you may come across errors that stop a transaction or delay your payment. These issues often appear without clear explanations on the screen. Many are linked to common system or user-side problems that lead to UPI payment failures.

Understanding the meaning of each error screen and acting in a timely manner prevents the need for panic and allows you to do the right thing within seconds.

1. Incorrect UPI PIN Entered

Users often enter an incorrect UPI PIN to authorise a payment request. This can happen in case the user makes an error in typing, the user does not recall the correct PIN, or confuses it with an ATM PIN.

Users enter the wrong UPI PIN while authorising a transaction. This could be due to typing errors, forgetting the correct code, or confusing it with an ATM PIN.

Quick Fix:

- Avoid retrying multiple times to prevent a temporary account lock.

- Use the “Forgot UPI PIN” or “Reset UPI PIN” in the UPI app.

- Grab your debit card for authentication because you will likely need the last 6 digits of your card number and expiry date.

- Create a new UPI pin and retry the payment.

2. Connectivity Issue (Internet or Mobile Network)

Switching between networks or having a very poor internet connection can hinder access to the UPI service (if the UPI app is unable to receive the data from the network). Hence, if you start your payment process and, for any reason, lose connection, this will stop the payment, thereby producing an error.

Quick Fix:

- Make sure you have a solid connection before attempting to make a payment.

- If you are close to a good mobile network signal, such as 4G or 5G, use that one.

- Don’t attempt to make your UPI payments while you move or in areas where the signal is low.

- If any issue occurs in the app, such that it freezes or hangs, close the app and re-open it.

3. Bank Server Down

The bank you are attempting to pay from or to is temporarily offline. This is common during peak traffic, planned downtime, or technical failures.

Quick Fixes:

- Wait and retry in 5-10 minutes.

- If the payment is urgent, try to send money from other linked bank accounts.

- Use alternate methods like IMPS or NEFT for time-sensitive transfers.

- Check the UPI app’s notification for known outages or delays.

4. UPI App Not Updated

UPI Apps that are not up to date may have bugs, issues, or outdated features that may cause failed transactions and poor performance.

Quick Fix:

- Open Google Play Store or App Store, search for your UPI app, and update.

- Clear app cache from your device settings to remove cached stored errors.

- Once the cache is cleared, restart your phone and attempt to re-open the UPI app, then try again.

- If issues persist, uninstall the app and reinstall it.

5. Transaction Limit Reached

UPI has limits on the number of daily transactions or the maximum daily transaction amount that can be transferred. Most banks typically allow:

- ₹1 lac transactions per day

- 10 – 20 transactions per day

If you have exceeded the everyday amount or the maximum number of transaction limits, it can temporarily block future transactions.

Quick Fix:

- Wait for 24 hours for the daily limit to reset.

- Use a different bank account if you have multiple bank accounts linked in your UPI app.

- For large payments, consider using NEFT/RTGS.

- Avoid multiple failed attempts, as it may trigger app restrictions.

6. Incorrect Receiver Details

the incorrect UPI ID or mobile number when completing a payment, or mistakenly scanning the wrong QR code, leads to errors or funds going to the wrong person.

Quick Fix:

- Always cross-check the UPI ID, Mobile Number, or QR ID prior to confirming any payment.

- If your app supports the “Verify UPI ID” – use it while transferring UPI by your mobile number.

- If you have not mistakenly submitted a payment to the wrong UPI ID, first contact the recipient, then your bank.

- If you cannot resolve the issue when the wrong recipient ID is contacted or the UPI transaction has gone through on your app, raise a grievance complaint through your UPI app or NPCI’s grievance redressal portal.

7. UPI Request Expired

There are certain types of transactions, especially collect requests (where someone sends you a request for payment), that are bound by time. If you take too long or do nothing at all, the payment request may expire. The delays or inaction can lead to expiry.

Quick Fix:

- Respond to collect requests as quickly as you can, as these requests usually expire in about 10 minutes.

- If the request has expired, ask the sender to resend the request for payment.

- For repeat payments, consider sending the money directly via UPI ID instead of waiting for a request.

Also Check: How to Change the UPI PIN in Google Pay?

How to Increase the UPI Payment Limit?

Conclusion.

Most UPI transaction failures happen because of system-triggered activity and are not fundamentally lost opportunities. Before the next failure happens and you are forced to retry, it is important to understand the reason for the transaction failure and decide on a suitable solution that applies a fix.

Frequently Asked Questions.

No, UPI was designed to work with your bank account. To send or receive money via UPI, you must link an active savings or current account using your mobile number registered with the bank.

If the status is still “processing,” wait to see what the status is amended to. If the status updates that funds have gone through, contact your bank urgently. You can also raise a dispute using your UPI app under the transaction details.

No, if you change your mobile number or SIM card then you will have to re-register on the UPI app using your new number attached to your bank. UPI will not authorize any transactions if it does not have verification.

Disclaimer:

The information in this article is for general awareness and troubleshooting only. It is encouraged that users contact their bank or UPI app provider for any specific account-related issues. Do not give out your UPI PIN, OTP or any secure bank information.