Digital payments have quietly become part of everyday life. From paying bills and ordering food to transferring money and shopping online, most transactions now happen with just a phone or a card.

Most people don’t think about payment security until something goes wrong. A wrong click, a fake message, or a moment of distraction is often enough to lose money.

To secure digital payments, it’s important to follow a few basic habits such as using strong and unique passwords, enabling two-factor authentication, downloading only official apps, avoiding public Wi-Fi, and keeping transaction alerts turned on.

This article explains how you can secure your digital payments in a practical, easy-to-follow way.

Understand Where the Real Risks Come From

Digital payment fraud usually doesn’t happen because systems are weak or outdated. In most cases, the fraud arises when people are rushed, distracted, or unaware. Some common risk points include:

- Clicking unknown links or QR codes

- Sharing OTPs or card details unknowingly

- Using public Wi-Fi for payments

- Installing fake or unverified apps

Once you understand that the real risk often lies in these everyday actions, preventing fraud becomes much easier.

Use Only Trusted Apps and Platforms

Always make digital payments using official and well-known apps downloaded from verified App Store or Play Store. Fake payment apps can look very similar to real ones and are often designed specifically to steal information without raising suspicion. Before installing any payment or banking app, take a moment to check:

- The app developer’s name

- Reviews and ratings from other users

- Whether the app was downloaded from an official app store

Avoid installing apps sent through links in messages, emails, or social media, even if they appear genuine. If an app asks for permissions that do not make sense for a payment service, it’s safer to avoid it.

Keep Your Phone Secure

Your phone is your wallet now. It holds access to your money, your payment apps, and your personal information. It is important to follow these simple steps such as:

- Using a strong screen lock such as a PIN, fingerprint, or face lock

- Never sharing your phone password with anyone

- Enabling auto-lock with a short timeout

- Keeping your operating system and apps updated

If your phone is lost or stolen, act immediately. Block access to payment apps and inform your bank as soon as possible. Quick action can prevent misuse.

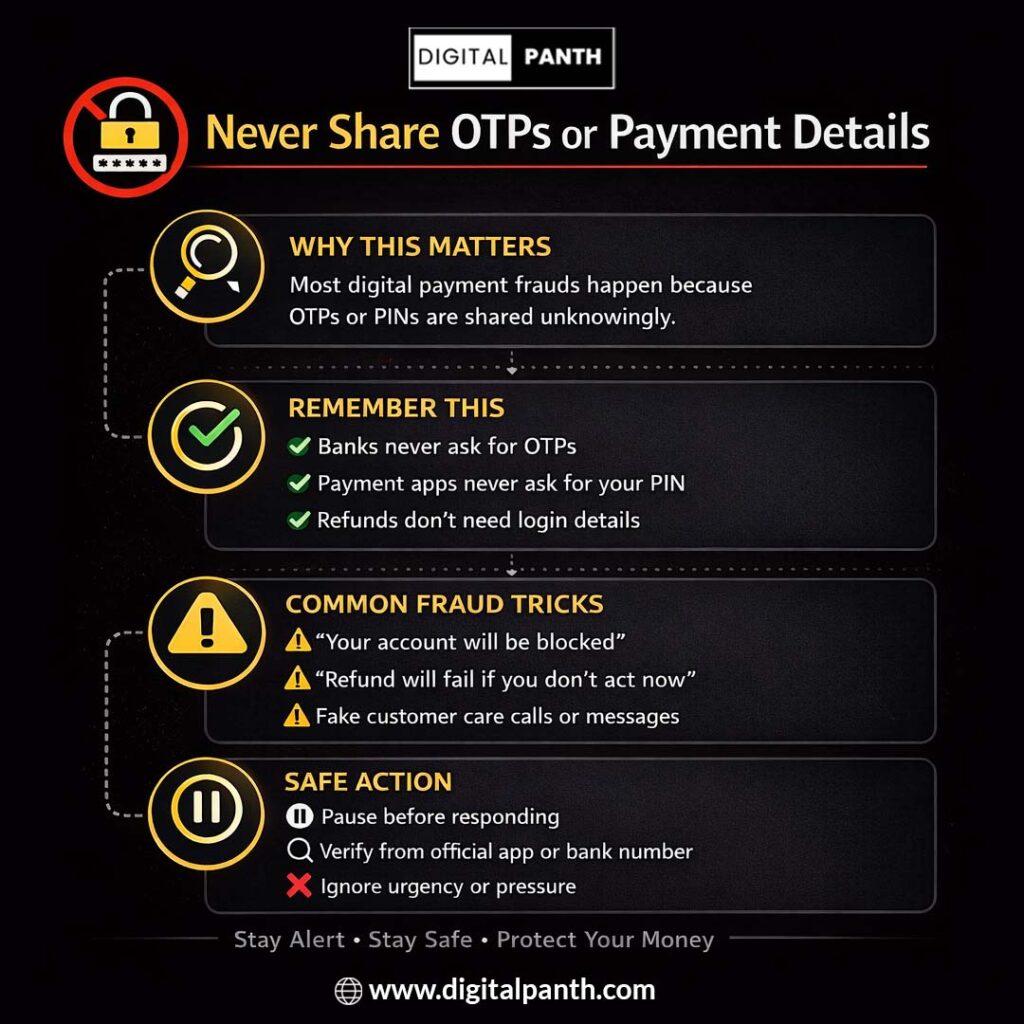

Never Share OTPs or Payment Details

This may sound obvious, yet it remains the most common reason people lose money. It’s important to remember:

- Banks and payment apps never ask for OTPs

- No customer care executive needs your PIN

- No refund, reward, or verification requires your login details

Fraudsters often rely on urgency to push people into making mistakes. They may claim your account will be blocked or promise that money will be credited only if you act immediately. This pressure is deliberate as it’s meant to stop you from thinking clearly.

Taking a moment to pause, think, and verify before responding can make all the difference, and that short pause is often enough to prevent a serious financial loss.

Be Careful with QR Codes and Links

QR codes are extremely convenient, but they are also commonly misused. A few important things to remember:

- Scanning a QR code is meant for paying money, not receiving it

- Never scan QR codes sent by strangers claiming refunds or rewards

- Avoid clicking payment links received through unknown messages

If something feels confusing, rushed, or unclear, it’s better to stop and check. Legitimate payment processes are usually straightforward and do not rely on urgency or secrecy.

Avoid Public Wi-Fi for Financial Transactions

Public Wi-Fi networks in cafes, airports, or malls may be convenient, but they are not secure. Using them for digital payments increases the risk of your data being intercepted.

If you need to make a payment while outside:

- Use your mobile data instead of public Wi-Fi

- Avoid logging into banking or payment apps on open networks

Waiting a few minutes or switching networks is far safer than risking your financial information.

Enable Alerts and Notifications

Transaction alerts act as an early warning system. They help you stay informed and react quickly if something goes wrong. Make sure you:

- Enable SMS and app notifications for every transaction

- Check alerts immediately after payments

- Report any unknown transaction without delay

The sooner you notice an issue, the better your chances of resolving it.

Use Strong and Unique Passwords

Using the same password everywhere may feel convenient, but it increases risk significantly. The better practices include:

- Using different passwords for banking and payment apps

- Avoiding obvious passwords like names or birth dates

- Changing passwords periodically

If remembering multiple passwords is difficult, a trusted password manager can be a safer option than reusing the same one everywhere.

Keep Limits on Payments and Transfers

Most banks and payment apps allow you to set daily transaction limits. Many people ignore this feature, assuming they will never need it. Setting limits helps because:

- Losses are restricted even if something goes wrong

- Suspicious activity becomes easier to detect

You can always increase limits temporarily when required, but having a default cap adds an extra layer of safety.

Be Extra Careful While Shopping Online

Online shopping is convenient, but it also requires caution.

Always:

- Shop on secure websites (look for “https”)

- Avoid saving card details on unknown platforms

- Double-check payment pages before entering details

If a deal looks too good to be true, it usually is. Taking a moment to verify can save you from unnecessary trouble.

Act Immediately If Something Goes Wrong

If you suspect fraud or notice an unfamiliar transaction, do not delay. Take action immediately:

- Block your card or payment app

- Inform your bank or payment service provider

- File a complaint as soon as possible

Delays reduce the chances of recovering money. Acting quickly improves your chances significantly.

Build Safe Payment Habits

Securing digital payments is not about fear, it’s about habits. Simple habits that help include:

- Taking a moment before approving any payment

- Verifying information before trusting messages or calls

- Keeping personal and financial details private

Over time, these habits become automatic and greatly reduce risk.

Conclusion

Digital payments are here to stay, and avoiding them entirely is neither practical nor necessary. Most payment frauds are preventable. With a little awareness and caution, you can enjoy the convenience of digital payments without constant worry.

Secure payments are not about technology alone, they are about how consciously we use it.

Frequently Asked Questions (FAQs)

Are digital payments safe to use?

Yes, digital payments are safe when you follow basic security habits like using trusted apps, strong passwords, and never sharing OTPs.

What is the most common reason for digital payment fraud?

Most frauds happen due to human error, such as clicking unknown links, sharing OTPs, or using public Wi-Fi for payments.

What should I do if I notice an unauthorized transaction?

If you notice an unauthorized transaction, act immediately by blocking your card or payment app and inform your bank or payment service provider to improve recovery chances.