UPI transactions in India may encounter issues such as payment failure, delay, and disputes. To address these problems, banks rely on back-office systems such as the BCS 2.0 RGCS portal, which helps trace transactions and manage customer grievances efficiently. It is a significant part of the process where banks and payment authorities manage transaction disputes and complaints about UPI and other digital payments.

This article explains what the BCS 2.0 RGCS portal is, why it exists, and how it fits into the UPI transaction and complaint ecosystem.

What Is the BCS 2.0 RGCS Portal?

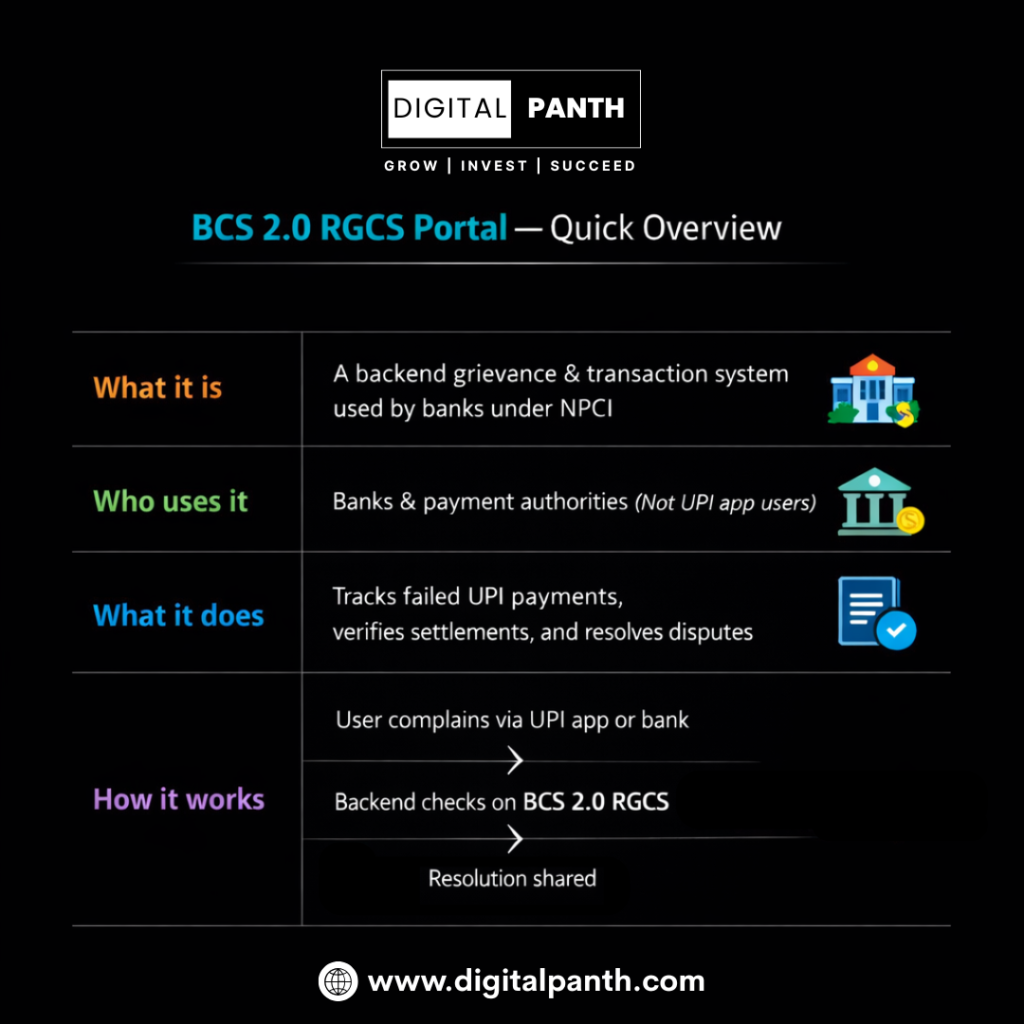

The BCS 2.0 RGCS portal is a backend transaction and grievance management system used by banks and authorised payment institutions under the framework of the National Payments Corporation of India (NPCI). The portal help institutions:

- Track digital transactions at a system level

- Investigate failed or delayed payments

- Handle disputes raised by customers through official channels

Importantly, this portal is not accessible to regular users. It functions as an internal platform for banks and payment service providers to coordinate and resolve issues efficiently.

Purpose of the BCS 2.0 RGCS Portal

With millions of UPI transactions happening daily, manual tracking of failed or disputed payments is no longer practical. Delays, technical issues, or settlement mismatches require a structured system that enables banks and payment authorities to handle issues efficiently.

The purpose of the BCS 2.0 portal is to help institutions:

- View transaction-level data

- Cross-check settlement records

- Monitor grievance timelines

- Ensure compliance with NPCI guidelines

The BCS 2.0 RGCS portal helps streamline this entire process by acting as a central backend platform for grievance tracking and resolution.

Key Features of the BCS 2.0 RGCS Portal

Although detailed technical access is restricted to authorised entities, the portal broadly supports the following functions:

- Transaction Tracking

Banks can trace UPI transactions using reference details such as UTR numbers to identify where a payment failed or got delayed.

- Grievance Management

Complaints raised by users through UPI apps, banks, or NPCI’s consumer portals are logged and processed through backend systems like RGCS.

- Inter-Bank Coordination

In cases where sender and receiver banks are different, the portal helps coordinate between institutions to resolve disputes smoothly.

- Settlement Verification

The system assists in checking whether funds were settled correctly between banks, reducing errors and duplication.

Role of the BCS 2.0 RGCS Portal in UPI Transactions

From a user’s perspective, UPI issues are handled through:

- The UPI app

- Bank customer care

- NPCI’s consumer complaint portal

However, once a complaint is raised, the investigation often moves to backend systems. This separation ensures that users get a simple experience, while institutions manage the technical complexity behind the scenes.

Can UPI Users Access the BCS 2.0 RGCS Portal?

No. The BCS 2.0 RGCS portal is not meant for public login or direct complaint submission by users. If you are facing a UPI issue, the correct approach is to:

- Raise the complaint via your UPI app

- Contact your bank’s customer support

- Use NPCI’s official UPI complaint portal

Once submitted, your complaint may internally be handled through RGCS or similar backend platforms.

Why Is the Portal Often Confused by Users?

Many users search for “BCS 2.0 RGCS ” hoping to:

- Check UPI transaction status

- Track refunds directly

- File complaints themselves

This confusion arises because the portal is part of the grievance ecosystem but not user-facing. Understanding this distinction helps users avoid wasting time searching for access that doesn’t exist.

Conclusion

The BCS 2.0 RGCS portal is a crucial component of India’s digital payment infrastructure that is often overlooked. UPI customers never have direct contact with the portal, but it supports banks and payment authorities in ensuring that all failed transactions, delays, and disputes are handled fairly and justly.

Every time you spot a UPI issue, report it through your app, bank, or NPCI’s official support channels – the backend systems will handle everything else.

Frequently Asked Questions (FAQ)

Is the BCS 2.0 RGCS portal the same as NPCI’s UPI complaint portal?

No. NPCI’s UPI complaint portal is user-facing and allows customers to raise complaints. The BCS 2.0 RGCS portal is a backend system used internally by banks and payment authorities under NPCI to investigate and resolve those complaints.

Can I track my UPI refund or failed transaction on the BCS 2.0 RGCS portal?

No. Users cannot access or track transactions on the BCS 2.0 RGCS portal. You can only track the status of your complaint through your UPI app, your bank, or NPCI’s official consumer support channels.

Disclaimer: This article is for informational purposes only. The BCS 2.0 RGCS portal is an internal system used by banks and payment authorities, and its processes are subject to change as per NPCI guidelines. Users should always rely on their UPI app, bank customer support, or NPCI’s official channels for filing and tracking complaints.