In 2025, the Indian government has stricter rules regarding Aadhaar linking to certain core services such as bank accounts, PAN cards, and mobile phone numbers to enhance compliance and security with these essentials. Understanding these updates is crucial for every Aadhaar holder to avoid service disruptions and leverage benefits effectively.

Latest Government Rules on Aadhaar Linking for 2025

Aadhaar-PAN Linking

From July 1, 2025, Aadhaar authentication has become mandatory for new PAN card applications. For existing PAN holders, linking PAN with Aadhaar is compulsory to keep PAN active for tax purposes.

The final deadline for Aadhaar-PAN linking for those who had obtained PAN using an Aadhaar enrolment ID has been extended to December 31, 2025. Missing this deadline will render the PAN card inoperative starting January 1, 2026, disrupting tax filings and financial transactions.

However, no penalty will be imposed if linkage is completed by the deadline for this category, while others linking after earlier deadlines may face a late fee of ₹1,000.

Aadhaar-Bank Account Linking

The Supreme Court ruling indicates that linking an Aadhaar number to a bank account is not necessary but it is used to access entitlements such as government subsidies, Direct Benefit Transfer (DBT), or other welfare schemes.

Many banks also integrate Aadhaar seeding to simplify KYC, avoid fraud, and enable seamless online transactions. The linkage can be done online or offline depending on the bank, and linking improves security by authenticating transactions via biometrics or OTP.

Aadhaar- Mobile Number Linking

Linking Aadhaar with a mobile number is not mandatory but highly beneficial. It enables receiving Aadhaar-related OTPs for authentication, seamless updates, and access to Aadhaar-based services. Currently, this process requires a visit to an Aadhaar Enrollment Centre or Aadhaar Seva Kendra for biometric verification – a fully offline process as online linkage is not supported by UIDAI.

Step-by-Step Aadhaar Linking Process with Screenshots

Linking Aadhaar to PAN Card Online

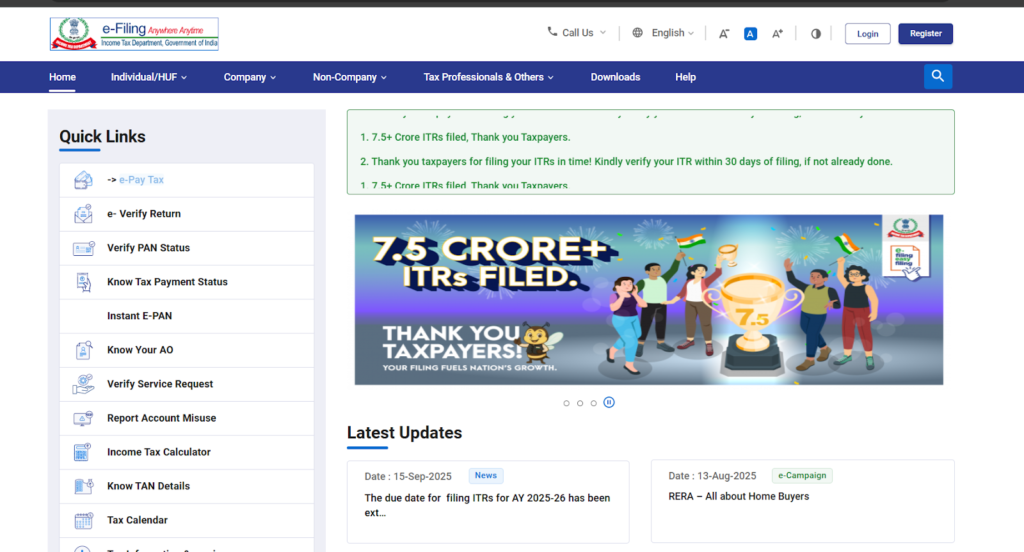

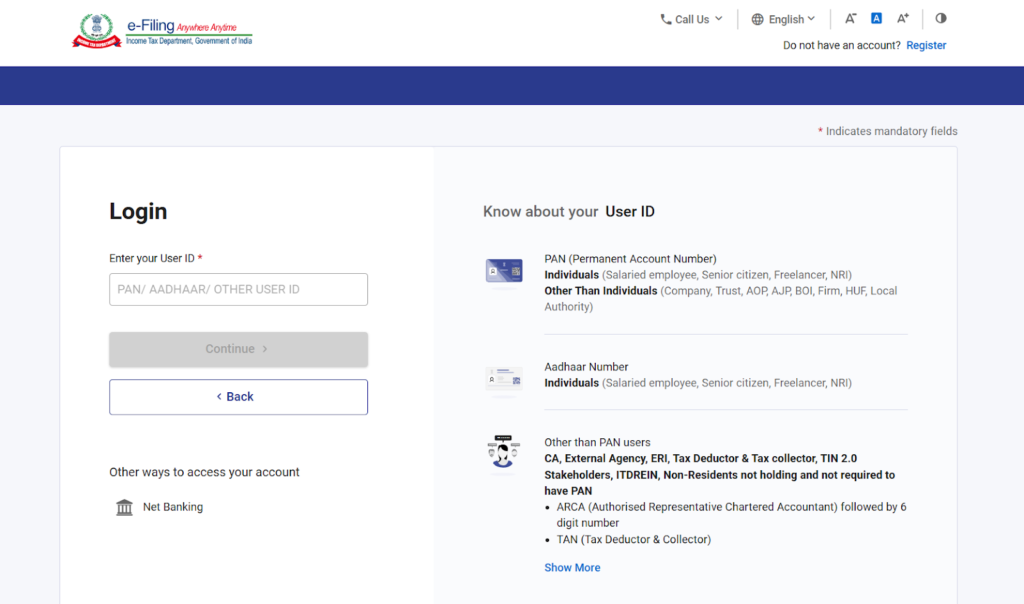

Step 1: Visit the Income Tax e-filing portal for Aadhaar-PAN linking.

Step 2: Select the option to link Aadhaar with PAN.

Step 3: Enter your 10-digit PAN number and 12-digit Aadhaar number.

Step 4: Validate by entering the captcha and submit your request.

Step 5: A confirmation message appears once linking is successful.

Linking Aadhaar to Bank Account Online

Step 1: Log in to your bank’s net banking portal or mobile app.

Step 2: Navigate to services under “My Account” or KYC update.

Step 3: Select the option to add/update Aadhaar number.

Step 4: Enter the Aadhaar number twice for verification.

Step 5: Submit the request and receive confirmation.

Step 6: Alternatively, send an SMS as per your bank’s format or visit the branch to submit a linking form with Aadhaar copy.

Linking Aadhaar to Mobile Number (Offline)

Step 1: Visit the nearest Aadhaar Enrollment Centre or Aadhaar Seva Kendra.

Step 2: Fill the Aadhaar update form specifying the mobile number update request.

Step 3: Submit the form with a photocopy of your Aadhaar card and valid photo ID proof.

Step 4: Provide biometric authentication (fingerprints/iris).

Step 5: Pay the nominal fee (if applicable) for mobile number update. The update typically reflects within 90 days.

Common Issues Faced by Users during Aadhar Updation

- Name mismatches causing failed linkages.

- OTP delivery failure due to unlinked or outdated mobile numbers.

- Delay in bank’s system updating Aadhaar linkage status.

- Requirement of offline biometric authentication for mobile number linking.

How Linking Affects Financial Transactions and Security

Financial Benefits and Convenience

- Aadhaar linkage enables Direct Benefit Transfer (DBT) of subsidies and welfare payments directly to bank accounts, reducing leakages and delays.

- Linking Aadhaar with PAN ensures tax compliance, smooth processing of income tax returns, and prevents duplicate PAN fraud.

- Aadhaar seeded bank accounts simplify KYC processes, enabling quicker loan approvals, digital payments, and seamless Unified Payments Interface (UPI) transactions.

Enhanced Security

- Aadhaar linkage adds biometric or OTP-based authentication to financial transactions, reducing identity fraud and unauthorized access.

- Banks use Aadhaar verification to confirm customer identities in real-time, improving account safety.

- Linking Aadhaar with mobile numbers helps receive OTPs directly and securely, preventing fraud in mobile banking and e-wallet transactions.

Conclusion

In 2025, the government has emphasized Aadhaar linkage more than ever to promote transparency, security, and ease of access in financial and government services. While linking Aadhaar with PAN is mandatory, linking with bank accounts and mobile numbers, though sometimes optional, comes with strong incentives and enhanced security features. Users should promptly complete all required linkages following the step-by-step procedures to avoid disruptions, enjoy government benefits, and secure their financial transactions.

Disclaimer: The information provided here is for general awareness purposes only and should not be treated as official advice. Readers are advised to verify details from the official government portals (UIDAI, Income Tax Department, RBI, or respective banks) before taking action. We are not responsible for any loss or inconvenience arising from reliance on this content.

Frequently Asked Questions

Aadhaar-PAN linking is mandatory. Aadhaar-bank account linking is not compulsory but required for government benefits. Aadhaar-mobile linking is optional but recommended.

PAN will become inoperative, blocking tax filing and financial services. A late fee may apply if linked after the deadline.

No, linking one Aadhaar to multiple bank accounts is generally not permitted under RBI guidelines.