A failed UPI transaction refers to an instance where money was deducted from your account, but was not received by the receiver. A failed UPI transaction could happen for several reasons, such as the server not functioning properly, slow internet speed, or the Bank being temporarily down.

This article explains step-by-step what you should do after a failed UPI transaction, how to raise a complaint, and where to go if it doesn’t get resolved.

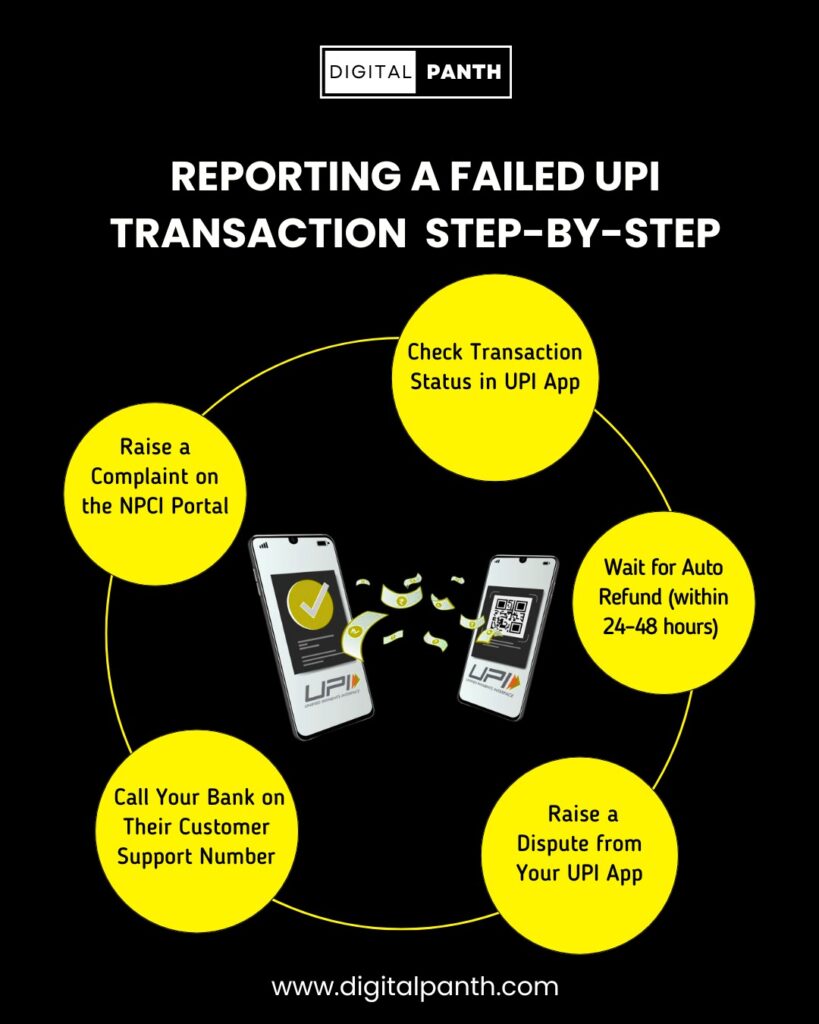

Step-by-Step Process to Report a Failed UPI Transaction.

When a UPI payment fails and money is debited from your account, don’t panic. Below are the steps that you should take to track your money and proceed to seek a refund.

Step 1: Check Transaction Status in UPI App

- Open the UPI app you did the transaction on – whether Google Pay, PhonePe, Paytm, or your Bank’s app.

- Then find – “Transaction History”, or “Activity” section.

- Find the transaction record, then tap it.

- From the details, you will see the status -“Failed”, “Pending”, or “Success”.

Also, note the UTR number (Unique Transaction Reference) – this will assist in tracking and raising complaints.

This step is important: Most users assume the money is gone, but in most cases, the app already presents the status and initiates the refund process.

Step 2: Wait for Auto Refund (within 24–48 hours)

Most transactions that fail to undergo via UPI will see the automatic refund process taking place within 24 hours to 48 hours.

- If status = Failed → You should see a refund initiated by the app without any action.

- If status = Pending → you can wait at least 1 hour, as sometimes server delays may take time.

Do not decide to retry the payment until you have resolved the issue, as this could cause you to be debited twice!

Step 3: Raise a Dispute from Your UPI App

If you haven’t received your refund after 48 hours:

- Open your app → Navigate to Help, Support, or “Raise Dispute”.

- Select the failed transaction.

- Select a reason for raising a dispute like: “Money debited but not received by receiver”, or “Transaction failed”.

- Raise the dispute and make a note of the ticket ID (if provided).

You might expect an app response within a few working days.

Step 4: Call Your Bank on Their Customer Support Number

If there’s no help from the UPI app support, just contact your Bank:

- Call the toll-free customer support number or visit a branch.

- Make sure you provide all relevant details:

- UTR number

- Date & and time of the transaction

- Amount

- Screenshot of failed transaction

- Your Bank has ways to escalate it internally.

For example, SBI is 1800 1234 or 1800 2100, and HDFC is 1800 202 6161.

Step 5: Raise a Complaint on the NPCI Portal

File a complaint directly at NPCI’s portal and fill in the details, such as the UPI app used, date of transaction, UTR Number, and type of complaint. Raise your complaint and get a reference number to track it. NPCI is the intermediary and coordinates the dispute between the bank and the app.

Last-Minute Tips to Avoid UPI Failures

Before making any UPI payment, ensure a stable internet connection. Unstable or interrupted connections can lead to timeouts and UPI payment failed errors.

- Avoid peak hours, say 8 PM – 10 PM, when banks have a lot of load on their server.

- Always take a screenshot of your payment confirmation screen, as it will be useful later for tracking or for lodging complaints.

- After making a UPI Payment, do not click ‘pay’ 5 times if it is still pending. Wait for the first attempt and check the transaction status before hitting pay again.

- Take note of the UTR number displayed with your transaction. You will need this to track refunds or complaints.

- Always use the official app store to update your UPI app. Do not download app bundles or other malware that scams you out of your bank details.

- Do not use UPI when switching mobile data to Wi-Fi; otherwise, payment could be interrupted.

- Check that your bank account is active and has a balance, and is not inactive or has a too-low balance; otherwise, the payment will fail.

- Do not use UPI on a rooted or jailbroken device, as these devices provide less security and or could block UPI.

- Do not use unverified UPI apps; always use trusted platforms/news providers like PhonePe, Google Pay, Paytm, BHIM, etc.

Conclusion.

UPI failures can be irritating, especially when money is debited but not received. However, in most cases, the money will be credited back to your account by itself within 24 to 48 hours. By checking the status of your transaction, getting your UTR number, and knowing where to file complaints, you will easily know how to track your refund. If nothing works to retrieve your money, escalate the issue to NPCI — you’re safer there.

Frequently asked questions (FAQ)

Normally, without complaining, the refund will automatically get processed in less than 24 to 48 hours. After that, if you have not gotten your money back, file a complaint using the corresponding UPI app or call your bank.

UTR (Unique Transaction Reference) number is a 12-digit ID to uniquely identify your transaction. It helps to track a successfully paid amount, including better follow-ups with your Bank or NPCI.

You should first wait for about one hour. After an hour, if it still reads ‘Pending’, then raise a complaint in your UPI app or contact customer care.

Disclaimer:

The information provided in this article is for general awareness and educational purposes only. DigitalPanth.com does not represent any bank, UPI app, or financial institution. While we strive to keep the information accurate and updated, users are advised to verify details with their respective banks or official sources before taking action.