The Indian Financial System Code (IFSC) is an 11-digit alphanumeric code that uniquely identifies a bank branch in India. It is mainly used for online money transfers via NEFT, RTGS, and IMPS.

Whenever you are sending a money online via transfer, you have to provide:

- Bank Account Number

- IFSC Code

Based on the IFSC, the funds are passed on to the right branch and the correct account holder. If an incorrect IFSC code is used, the transaction can either fail, be delayed, or get credited to the wrong account.

IFSC Code Structure

The 11-character alphanumeric code is not a set of letters and numbers. Each part of the code have specific meanings and purposes. The Reserve Bank of India (RBI) lets the codes ensure the smooth and accurate transmission of funds by NEFT, RTGS, and IMPS.

Now, let’s move on to the IFSC code structure.

- First Four Characters (Alphabets) – Bank Identifier

They are always alphabets, representing a short form of the bank’s name. This helps to identify through which bank the transaction is being processed. The first four characters of an IFSC code will be the same for every branch of a particular bank.

Example: SBIN=State Bank of India

- Fifth Character – Zero (0) Always

The fifth character in every IFSC code will always be ‘0’. This zero has been reserved for future usage (perhaps coding upgrades) and hence will never change. It stands as a fixed separator between the bank and branch identifiers.

- Last Six Characters (Alphanumeric) – Branch Identifier

This section is either numbers or a combination of letters and numbers. It identifies the exact branch the account is opened at. The combination of the last six characters to the first five characters will not be duplicated in any two branches across India.

For example: In SBIN0000454, the 000454 is the complete branch code for a specific SBI Branch.

Key Points to Note

- Uniqueness: Each IFSC code is unique to each bank branch.

- RBI Oversight: Every IFSC code is assigned, and regulated, by the Reserve Bank of India.

- Transaction Importance: If an incorrect IFSC code is put in place, there will be many delays, rejected transactions or failures in transferring funds.

- Invoice Process: If, in future, the bank and branch name changed after a merger; then the IFSC code will be updated and eventually published by the bank.

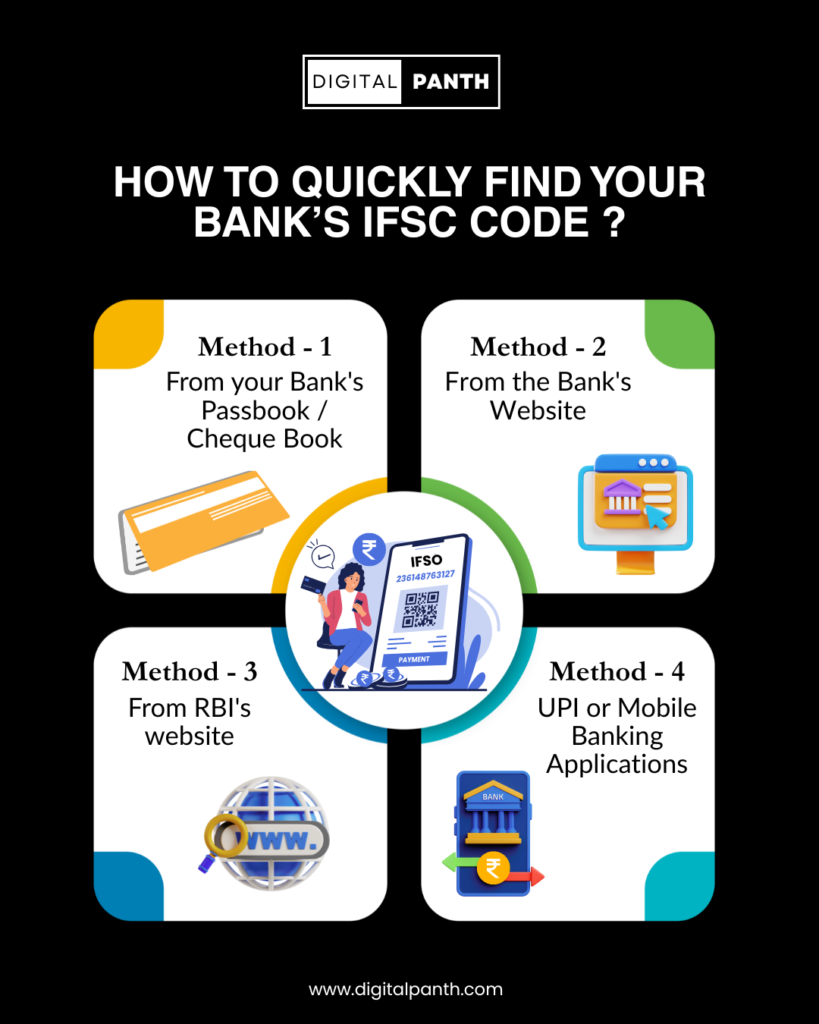

How to Quickly Find Your Bank’s IFSC Code?

Finding your bank IFSC code is not difficult. Neither is it necessary for you to contact the branch on every instance of you needing the IFSC code. Here are the best methods and most recognised ways to find the IFSC code:

Method 1: From your Bank’s Passbook / Cheque Book

Passbook: The IFSC code of the branch will normally be printed on the first page of your passbook along with your account details, branch address, and the MICR code.

Cheque Book: The IFSC code is printed on each cheque leaf, normally at the top (near to the bank name) or in the MICR section at the bottom of the cheque.

For example, if you are using an SBI passbook, you can find something like SBIN0000454 written right next to the branch name.

Method 2: From the Bank’s Website

Almost all of the banks always have a branch locator tool or IFSC search option on their official website. In this case, you only have to mention the branch name or city and the website will show you the IFSC code of the branch.

For example, in HDFC Bank’s website, if I type “Lucknow – Hazratganj” in the branch locator tool, it will show me the full address, IFSC code, and even the phone number.

Method 3: From RBI’s website

Reserve Bank of India maintains an updated list of IFSC codes of all bank branches. Once the bank name and location of the branch are selected, use IFSC Search Tool to find the IFSC Code.

Method 4: UPI or Mobile Banking Applications

In most of the UPI and mobile banks, once a new beneficiary is added, the IFSC code is displayed automatically. If you want to know the IFSC code, you should be able to check account details of an already saved payee.

Example: Try SBI YONO; Beneficiary Management → select the account; IFSC code appears under branch details.

Conclusion

The IFSC code is a small but important part of your online banking in India. It guarantees that your money will reach the correct account without delays or errors. Write down and check the IFSC code before performing any transactions to have a hassle-free experience.

Frequently Asked Questions

The Indian Financial System Code (IFSC) is an 11-character alphanumeric code issued by the Reserve Bank of India (RBI) which uses it to identify each branch of a bank.

IFSC is important because it gives the banks assurance that their online money transfer service in NEFT, RTGS, or IMPS.

No. In India every bank and its branches have their own IFSC code.

The easiest way to find the IFSC codes for your bank is on your passbook, cheque book, or on your bank’s official website, Reserve Bank of India’s official website, or Unified Payments Interface (UPI).

Disclaimer:

The information in this article is meant for general guidance only. While we try to keep it accurate and updated, bank IFSC codes and related details may change without notice. Please verify the information with your bank or the Reserve Bank of India before making any financial transactions