The Sukanya Samriddhi Yojana (SSY) is a small savings scheme instituted by the Government of India in 2015 under the Beti Bachao Beti Padhao (BBBP) scheme. The scheme was started to encourage savings toward the education and marriage expenses of a girl child, simultaneously offering attractive interest rates and tax benefits.

Parents or legal guardians may open an SSY account for a girl child below 10 years in any post office or authorised bank branch. Deposits can be made for 15 years, and it matures 21 years from the date of opening.

SSY accounts give one of the highest returns of all small savings scheme accounts, thereby giving 100% exemption to the earned interest against income tax. Deposits made as contributions towards the SSY account can also be claimed under deduction Section 80C of the Income Tax Act. In essence, SSY is a long-term, safe investment.

SSY aims to ensure the financial security of the girl child’s future and help parents accumulate funds for higher education or marriage without bearing a financial load.

Objectives of SSY

The main objectives of SSY are:

- Long Term Savings: Helping the parents in creating a secure checkout to fund their daughter’s college fees or marriage expenses somewhere down the line.

- High & Safe Returns: Being one of the schemes that provide the highest interest among small savings schemes, the interest and other receipts are absolutely safe and guaranteed by the Government of India.

- Tax Benefits: Allow deductions from investments under Section 80C, whereas interest income and maturity amount are free from taxation.

- Girl Child Welfare: Foster the mission of Beti Bachao, Beti Padhao by gearing up with financial planning and security for girls throughout the country.

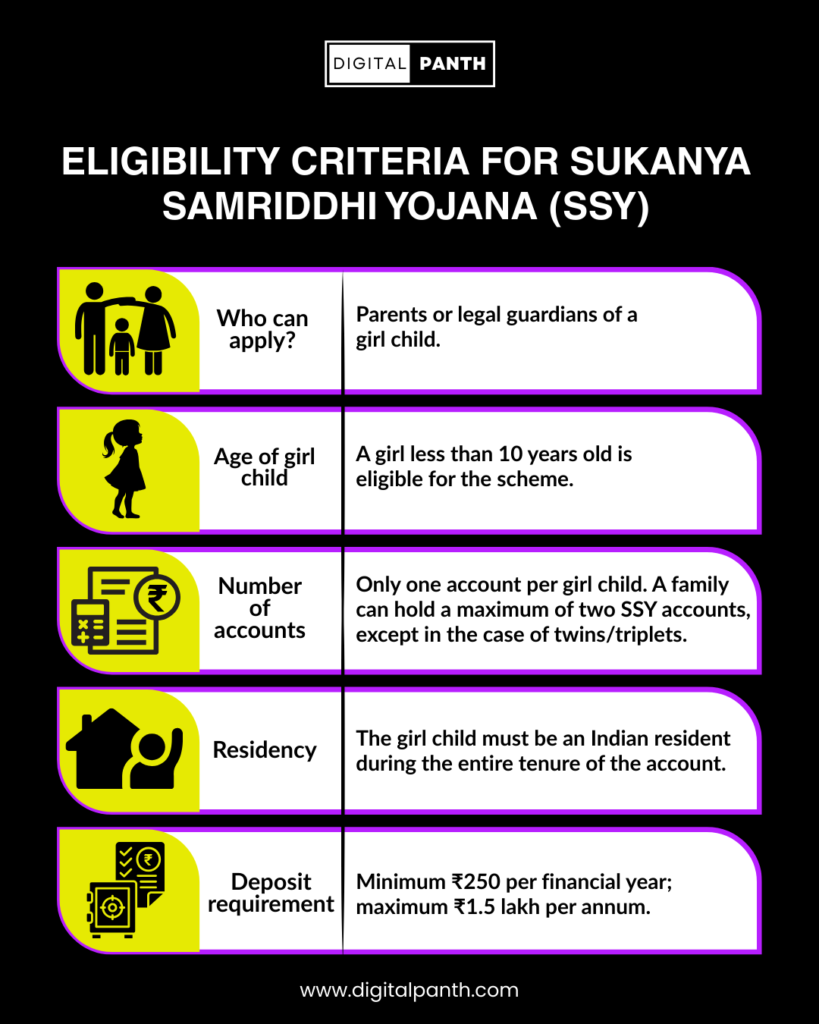

Eligibility Criteria for Sukanya Samriddhi Yojana (SSY)

To be eligible to access the benefits of SSY, applicants have to comply with eligibility requirements. Information is summarized as follows:

| Criteria | Details |

| Who can apply? | Parents or legal guardians of a girl child. |

| Age of girl child | A girl less than 10 years old is eligible for the scheme. |

| Number of accounts | Only one account per girl child. A family can hold a maximum of two SSY accounts, except in the case of twins/triplets. |

| Residency | The girl child must be an Indian resident during the entire tenure of the account. |

| Deposit requirement | Minimum ₹250 per financial year; maximum ₹1.5 lakh per annum. |

Who Gets Priority Under SSY?

SSY is open to all eligible applicants, but special focus is on ensuring benefits reach the most deserving families, especially those from weaker and rural backgrounds. Such groups include:

| Focus Group | Details |

| Girls from rural & under-served areas | Encourages savings for daughters in places where it is a less common practice, while promoting inclusive growth. |

| Daughters of low-income families | Very affordable, with just a minimum deposit of ₹250 a year, enabling almost all economically weaker sections of society to participate. |

| Families having only girl child | Designed for the one-girl child or eldest girl child to ensure long-term financial security. |

Not Eligible: Boys and families without girl children; families with more than two girl children (with certain exceptions); and accounts opened after the age limit of 10 years.

How to Apply for Sukanya Samriddhi Yojana (SSY)

It can be applied either way, that is offline or online.

Application Procedure – Offline

Step 1: Reach your nearest Post office or a bank branch.

Step 2: Ask for the account-opening form for Sukanya Samriddhi Yojana.

Step 3: Fill up the form and attach photocopies of all the necessary documents such as birth certificate of girl child, identification, or address proof of the guardian.

Step 4: Make a deposit of a minimum sum of Rs. 250 to open the account.

Step 5: Collect the passbook for SSY which shall be taken as a certificate for opening the said account.

Application Procedure – Online (Only for a few banks)

- Log in on net banking/ mobile banking.

- Proceed to Small Savings Schemes and select Sukanya Samriddhi Yojana.

- Enter all the details of the girl child and the guardian.

- Choose the deposit amount and complete e-KYC if applicable.

- Submit the application and confirm account creation.

Conclusion

Sukanya Samriddhi Yojana is a safe and high-interest saving scheme that helps parents accumulate a large sum for the education and marriage of their daughters, giving further impetus to the Beti Bachao Beti Padhao campaign.

Frequently Asked Questions (FAQ)

No. Only one account is permitted either at a post office or an authorized bank branch for every girl child/

Accounts can be opened for two girl children of a family. In special cases like that of twins or triplets, the number of allowed accounts is more.

The rate of interest is revised every quarter by the Government of India. The latest rate is available at your bank, post office, or on the Finance Ministry’s website.

Disclaimer:

The details provided about Sukanya Samriddhi Yojana (SSY) are for general information only. Scheme rules, interest rates, and eligibility may change as per Government updates. Please verify the latest information from official sources before making any investment.